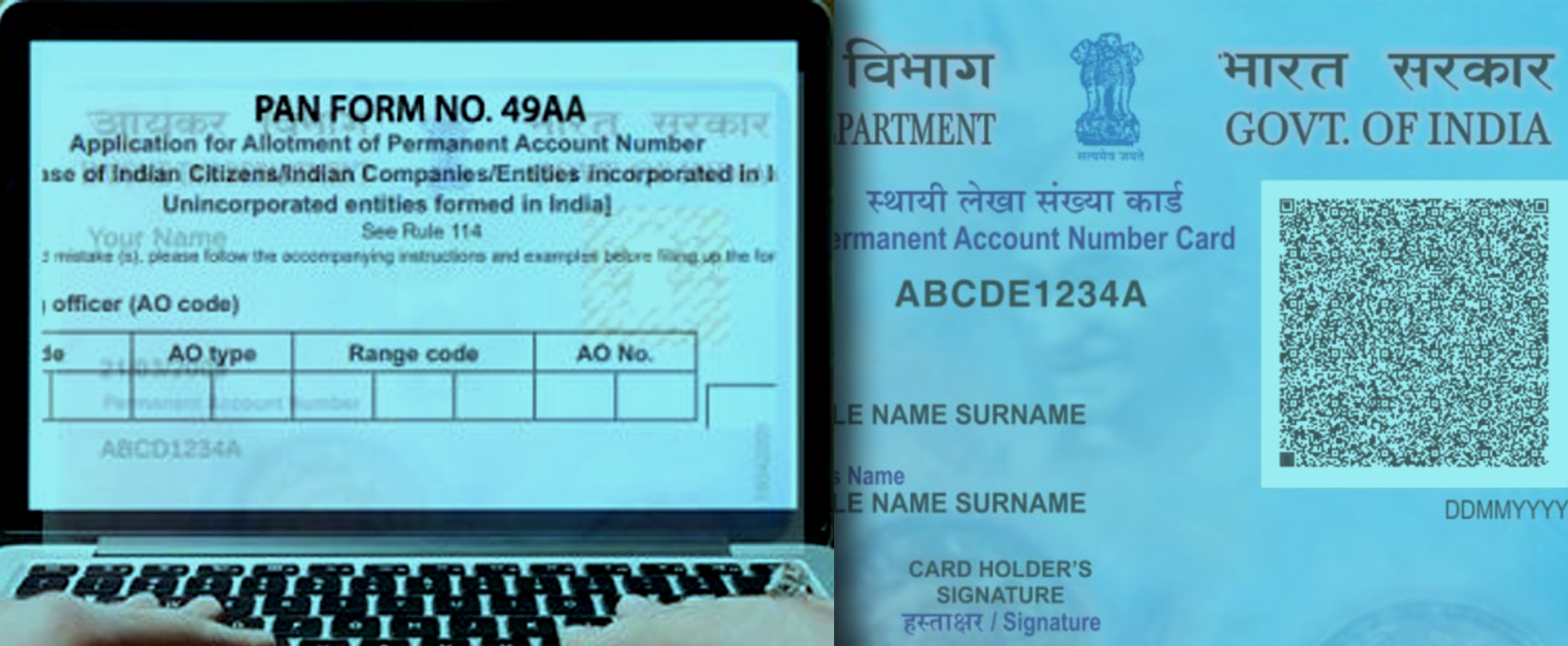

How to Fill 49AA Pan Form

Jan 30, 2020

Alankit

PAN Form 49AA is an application form used by all those who are either non-Indian citizens or any non-individual entity incorporated outside India. Foreign investors who aspire to do business or invest in India are required to hold a PAN card to execute the financial transactions. For foreign nationals Form 49AA is required to get filled up for the issuance of PAN card. Form 49AA is available online and can be downloaded from Alankit’s website. KYC details of the applicant is required in this form and it should be correctly filled by Foreign Institutional Investor or a Qualified Foreign Investor as specified under regulations stated by Securities and Exchange Board of India (SEBI). Permanent Account Number is a mandate 10-digit alphanumeric code for all income-earning individuals or non-individuals in regard to income tax payment and to avail government subsidies.

Structure of Form 49AA

There is no major difference between the PAN application forms - Form 49AA and Form 49A Individuals filling Form 49AA only need to provide their basic details as a mandate for the applicant’s KYC process.

For Individuals:

- Marital status of the applicant

- Citizenship Status of the applicant

- Applicant’s Occupation details- Private sector service, Public sector/Govt. service, Business

- Professional, Retired, Agriculturist, Housewife, Student or Other

For Non-Individuals:

- Type of company- Public Company, Private Company, Financial Institution, Body Corporate, Charitable Organization or Non-Government Organization

- Gross Annual Income in INR

- Net-worth (Assets less liabilities) in INR

- Taxpayer Identification Number in the residential country

- Does it have a small number of people or people of the same family possessing beneficial ownership and control

- Is the entity involved / furnishing any of the following services- Money Changer, Foreign Exchange, Gaming/ Lottery services / Gambling or Money Lending, Pawning

- Whether the applicant or the applicant’s authorized signatories/ office bearers / trustees are related to a politically exposed person

Components of Form 49AA

The detailed explanation of all the components present on Form 49AA is given below:

- Code of Assessing Officer- In this part, the applicants should mention their Assessing Officer code details such as the Area code of the accounts office, Range code, Accounts office type, and Accounts office number.

- Full name- This is the section of the form where the individuals should mention their marital status along with their first name, last name and Sur name.

- Abbreviation of the name- In this section, the applicants should abbreviate their name based on what they want on the PAN card.

- Other name- Applicants can mention the details of their other name if they were ever known by another name other than the name already mentioned.

- Gender- The applicants should mention their gender.

- Date of birth- In case of an individual applicants, they should mention their date of birth while in case of an organization, the date of incorporation/partnership/Agreement should be there

- Father’s name- The applicants should mention the first name, last name and surname of their father in this section. This is applicable not only to individual applicants but also married women should fill in this part of the form as a mandate

- Address- The applicants needs to enter their residential address information and office address in this section of the form. The applicants need to be careful while filling in the address and must provide the correct information.

- Address of communication- The applicants should fill the address at which they would like to be contacted at.

- Telephone number and email id- The Country code, State code and mobile /telephone number for communication purposes are to be entered in this section.

- Status of applicant- The applicants should mention if they are an individual, a Company, Partnership firm, a HUF member, etc.

- Registration number- The registration number specifies the registration number for a firm, company, LLPs, etc.

- Citizenship- The country of citizenship and ISD code of country of citizenship in this part of the form is to be filled by the applicants.

- Representative of the applicant in India- Applicants should mention details of the representative or the agent including full name and address.

- Documents submitted- Applicants are required to mention all the documents they have submitted with the form.

- KYC details- As per the regulations stated under SEBI, this part of the form should be filled in by a Qualified Foreign Investor. This part will contain details like citizenship status, marital status, occupation details, and more.

Necessary Documents Required with the Form 49AA

Citizens outside country are supposed to submit essential documents along with the Form 49AA for Identity and Address proof. Below mentioned are the documents needed to submit with the application form:

Documents for Identity Proof:

- Driving license

- Aadhaar Card

- Pensioner card with the applicant’s photograph

- Passport

- Arm’s license

- Any photo ID card issued by a government body

- Bank certificate

Documents for Address Proof:

- Aadhaar card

- Bank account statement

- Broadband connection bill

- Electricity bill

- Landline bill

- Water bill

- Consumer gas connection

- Depository account statement

- A domicile certificate issued by the government

- Post office passbook

- Applicant’s passport

- Passport of the spouse

Procedure to Obtain & Submit the form:

- Individuals can simply download the application form from our website.

- After filling the form completely and correctly, applicants should submit the same to any Alankit’s center along with the required documents and can make the payment thereafter.

- Individuals can also courier the documents in case they cannot locate a nearby Alankit center. Having document approval from Alankit representative, Individuals can make payment to Alankit account.

Note: Individuals should submit their primary documents such as identity proof (POI) and address proof (POA).

- Applicants will be issued acknowledgment number for the PAN Application and PAN Card will be sent to the provided address.